- Arigato Insiders Newsletter

- Posts

- We checked the chart

We checked the chart

👀 👀

Arigato, dear investor,

Yesterday, I was at the moomoo investment conference, spending the day with a group of familiar faces — financial creators, investors, people who live and breathe the markets.

During one of the breaks, we started chatting casually about our portfolios.

What we’ve been buying.

Which dividend stocks we’re holding going into 2026.

At some point, I mentioned, almost in passing:

“I added UOB about 2 months ago.”

Someone looked up and said,

“Wait… how is UOB doing now?”

So I took out my phone.

Opened the chart.

And for a moment, all of us just stared. 👀👀

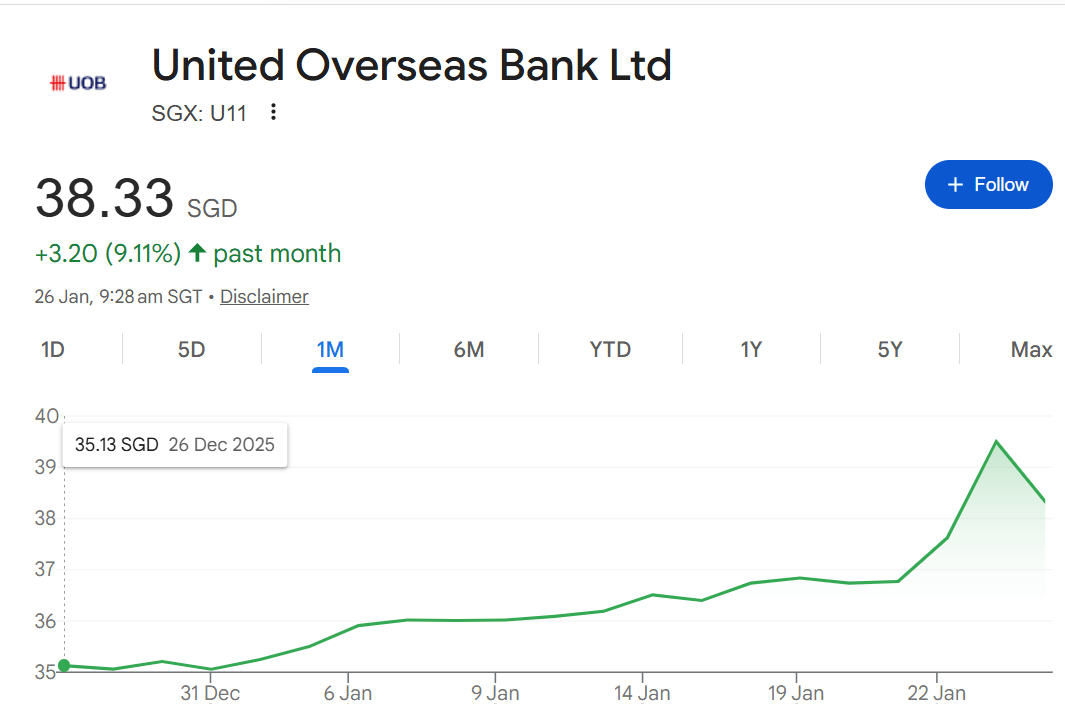

UOB is up more than 9% in just 1 month.

What made that moment especially interesting was this —

just months ago, UOB was the stock many investors had quietly given up on.

For almost six months, its price kept drifting lower, while the other two SG banks were rallying hard. Confidence faded. People moved on.

Then came the earnings release. Headlines called it “disappointing.”

Sentiment weakened even further.

I remember seeing many investors lose faith around that time.

But if you slowed down and actually read why earnings dipped — not just the headline numbers — the story wasn’t nearly as negative as it sounded. This is where understanding how banks truly make money matters.

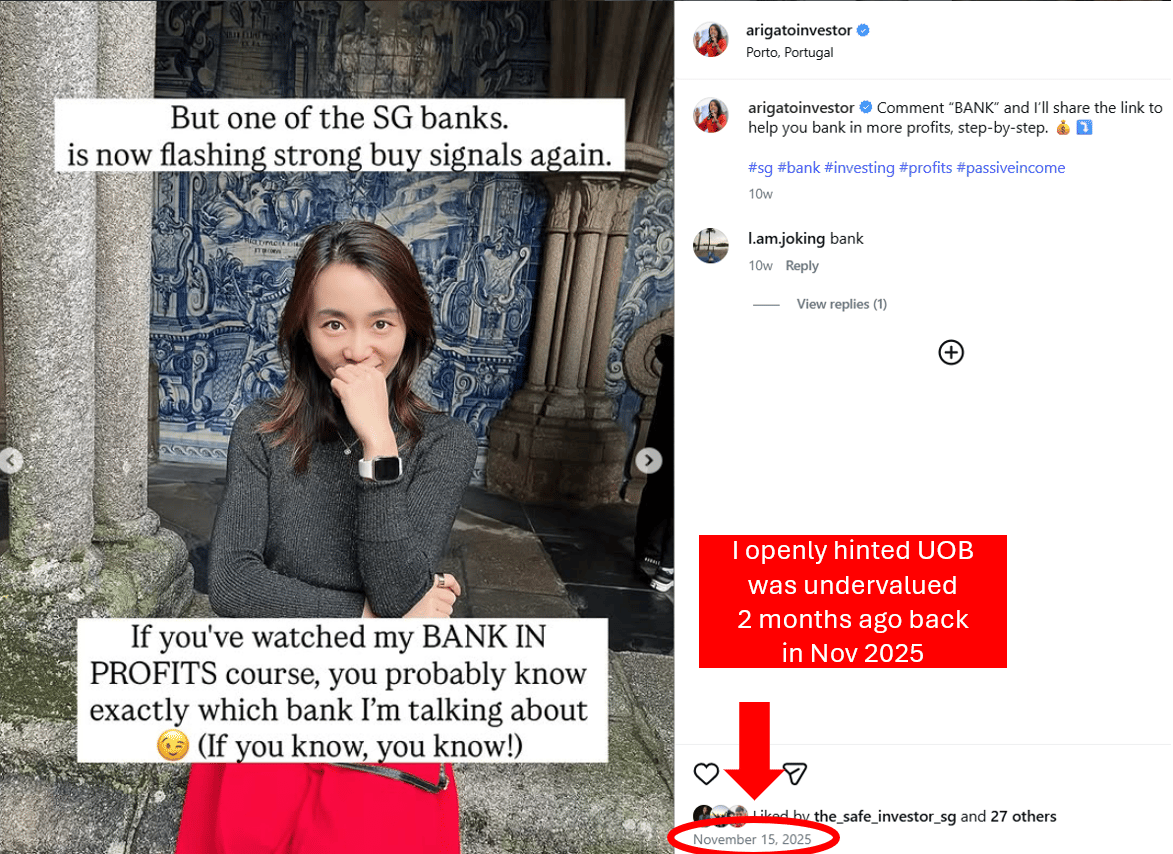

When I applied that my Bank In Profits framework last November,

UOB stood out clearly.

Not because it was exciting.

But because it was undervalued.

That was why I openly hinted about it back then on my IG.

And why I personally added more shares during that period.

Fast forward to today, and the market is catching up.

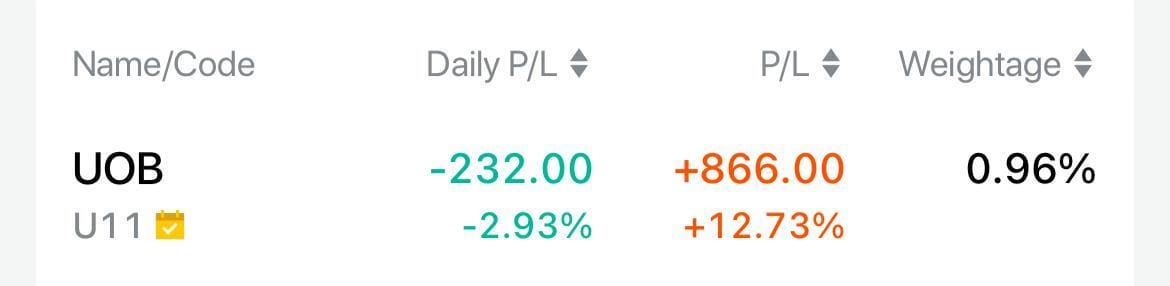

And this is what that decision looks like now:

~12.73% capital gain in about 2 months

~6% annual dividend yield

Ownership in a solid, well-run bank that continues to grow and pay shareholders steadily increasing dividends over time

It’s a good reminder that when you buy quality businesses at the right valuation, returns don’t need to be dramatic — they can be calm, consistent, and repeatable.

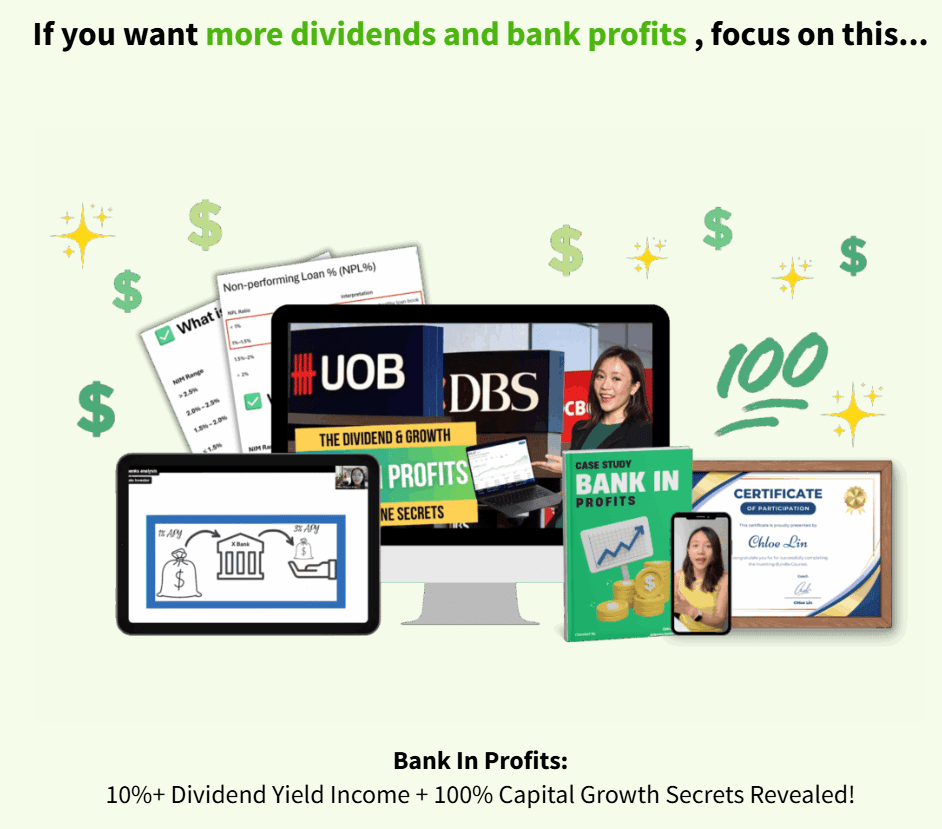

This is exactly what I teach inside my BANK IN PROFITS investing framework.

If you’ve ever felt like you:

buy only after prices have already run up

feel uneasy when stocks dip

or aren’t sure how to tell a real opportunity from noise

Then the real solution isn’t chasing better tips.

It’s learning how to analyse properly, so you can invest with clarity and calm.

That’s why I created my 7 Investing Course Bundle — to walk you step by step through how I analyse opportunities like SG bank stocks, without stress or guesswork.

As a New Year bonus, you’ll also receive my 2026 Investing Game Plan Workshop Replay — completely free upon signing up.

In it, I share how I think about building a balanced, resilient portfolio for the year ahead, inspired by long-term investors like Warren Buffett.

No hype.

No rushing.

Just a clear plan and steady progress.

If this resonates, I’d love to have you inside.

Meanwhile, check out this 👇️

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Reply