- Arigato Insiders Newsletter

- Posts

- WARNING: 40% TAX

WARNING: 40% TAX

Hey dear investor,

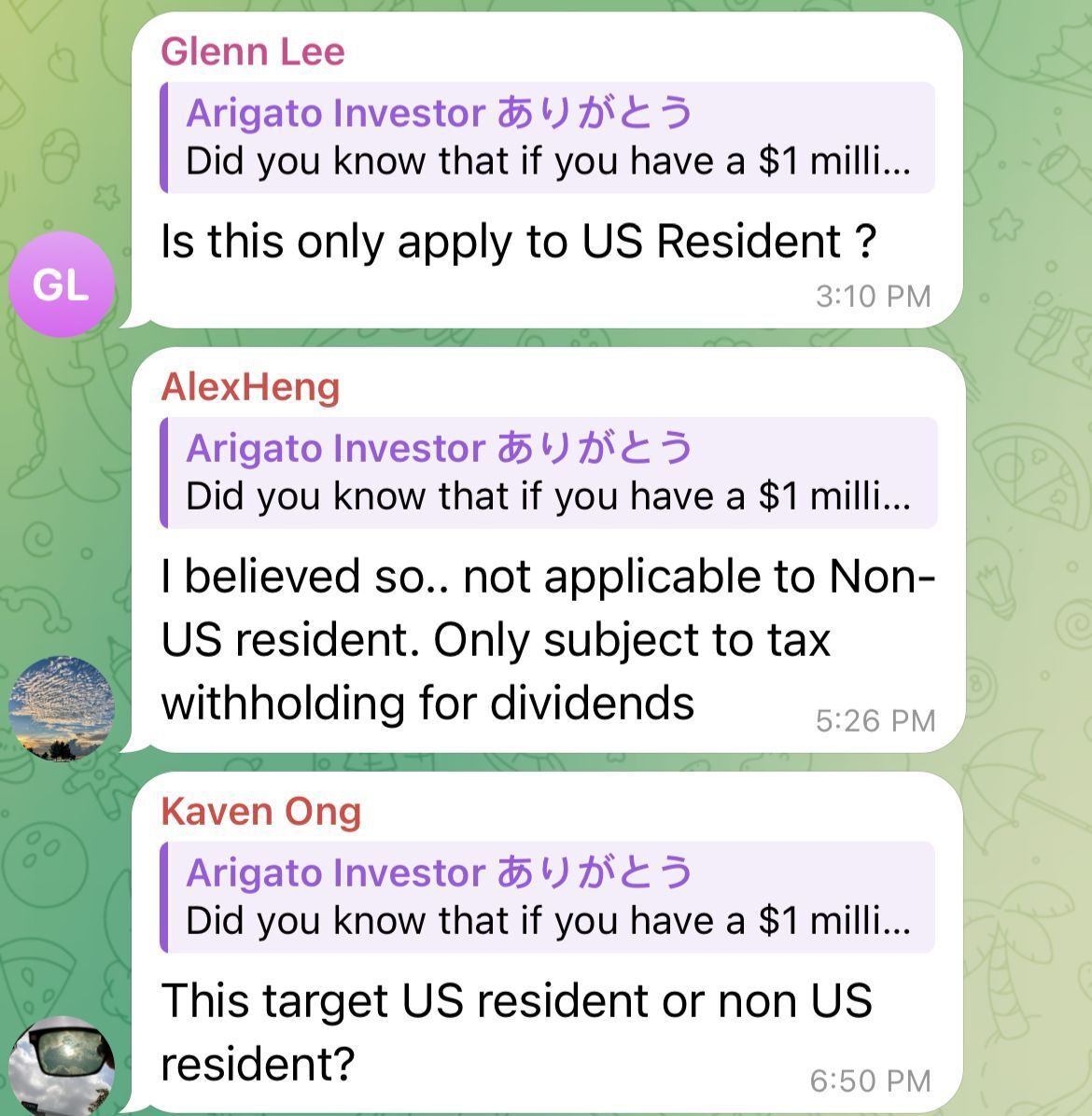

Since I sent out the email yesterday, I’ve been getting questions asking, “Is this masterclass relevant for non-U.S. citizens?” Let me clear the air:

YES, it’s absolutely relevant!

If you’re from Singapore, Hong Kong, Malaysia, or any other non-U.S. country, and you invest in U.S. assets—like stocks, ETFs, or even cash in brokerage accounts—then this masterclass is for YOU.

Here’s why:

The U.S. government can impose up to 40% estate tax on your U.S.-situated assets, BACAUSE you’re a non-resident! That means your hard-earned portfolio could face unnecessary losses unless you know how to protect it.

What You’ll Learn in the K.O. Tax Boss Masterclass

How estate taxes impact non-U.S. investors like us.

The strategies to legally avoid up to 40% estate tax.

How to keep your wealth safe, secure, and growing—on your terms.

If you’re serious about protecting your investments and legacy, this is your chance to learn how to safeguard your portfolio.

📅 Important Reminder:

Date: Tomorrow! 27 Nov

Time: 8PM

Where: Live on Zoom (100 seats only!)

We’re keeping it small to make it personal, so don’t miss your chance—

CLICK HERE to register now before it’s full. 👈️

Warm regards,

Chloe

Arigato Investor

P.S. If you’re serious about keeping up to 40% of your wealth, don’t wait.

Click Here to Register For Free K.O. Tax Boss Masterclass.

Reply