- Arigato Insiders Newsletter

- Posts

- UP

UP

🔼🔼🔼

Arigato, dear investor,

I’m currently inside moomoo’s Investment Retreat for financial creators, spending this weekend at Sofitel Sentosa — and honestly, it’s been such an energising experience.

What made it special wasn’t just the beautiful venue.

It was the conversations.

Being in the same room with fellow creators, investors, and traders — exchanging ideas, debating markets, and learning how everyone is positioning for the next phase — reminded me how powerful it is to learn together.

What really stood out was this:

moomoo also invited their in-house representatives and analysts to share their 2026 market outlook.

Here are the 3 key insights that really stayed with me — and why I think they matter for you too.

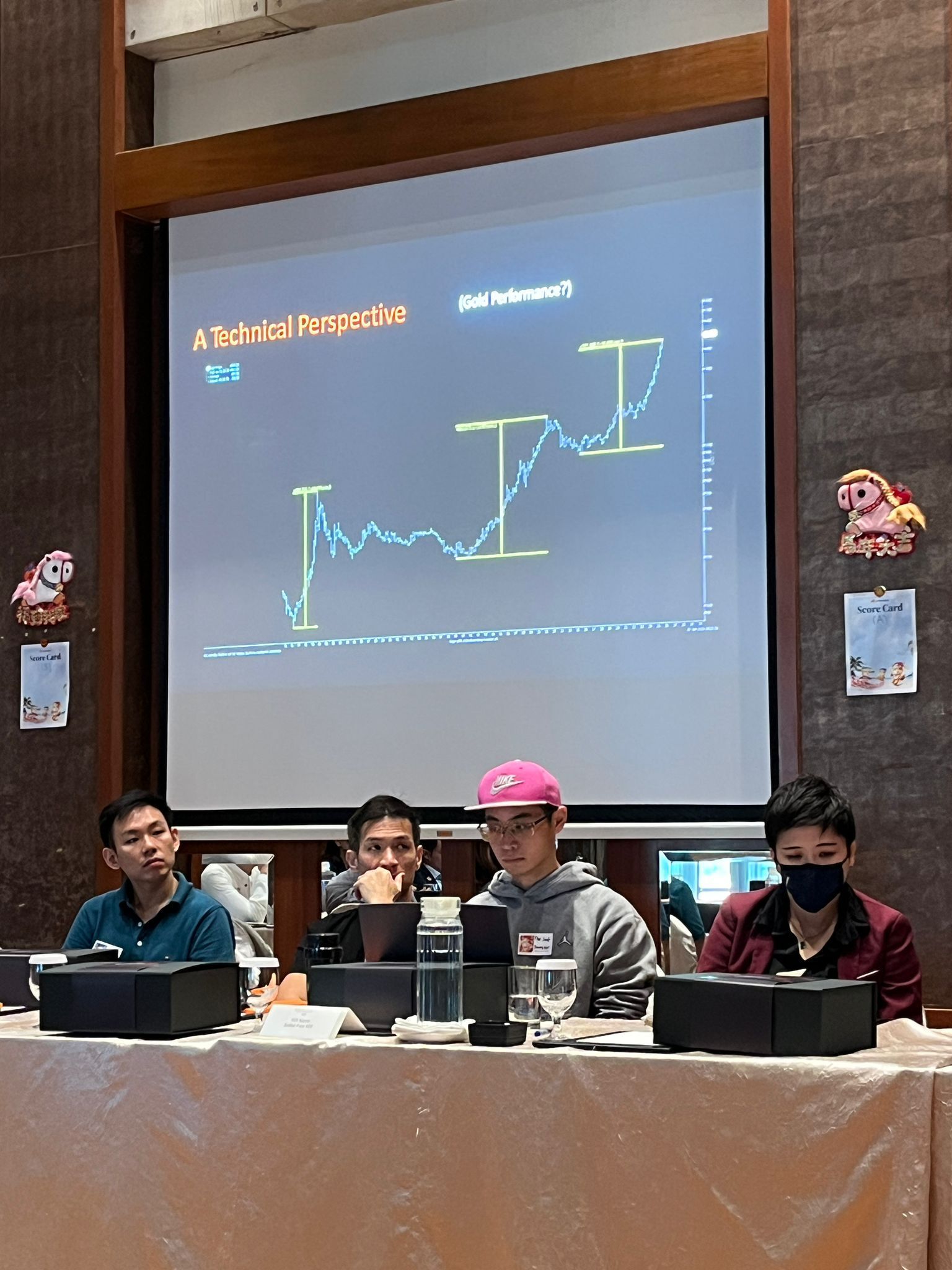

1. Gold may still have room to run

Yes, gold has already risen significantly — about 80% in the past year.

But zooming out, the analysts showed a fascinating historical pattern dating back to the 1950s.

In the last two major gold rallies:

One saw prices rise ~770%

Another gained ~680%

We now appear to be in the third major rally.

So far, gold has climbed about 370% from its base.

If this historical pattern continues, there could still be meaningful upside ahead before things eventually cool off.

This reminded me why, during my 2026 Investing Game Plan Workshop, I shared gold as one of the assets ETF investors can use to diversify.

If you took action back then, chances are you’ve already seen solid 10% gains from gold exposure.

And no — this isn’t about chasing hype.

It’s about understanding why certain assets continue to hold long-term value.

2. Emerging markets could see stronger momentum in 2026

Over the last 5 years, the US market has risen more than 80%, attracting massive capital inflows.

But as the US dollar weakens, analysts expect some of that capital to rotate elsewhere — particularly into Asian emerging markets.

We already saw signs of this:

China markets rebounded strongly last year

Singapore markets also showed renewed strength

If capital continues flowing into Asia, this trend may persist into 2026.

It’s a reminder that opportunities don’t always sit where the headlines are loudest.

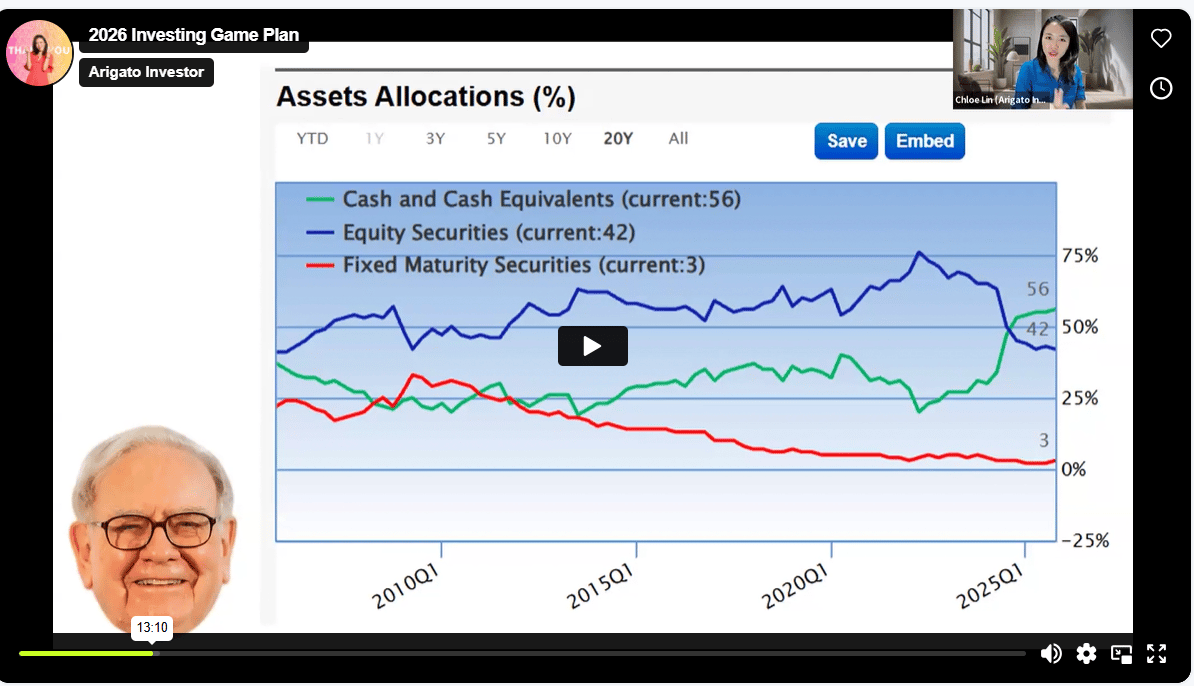

3. A barbell strategy may make more sense now

With US markets at all-time highs and uncertainty still elevated, the analysts shared that being more intentional with risk matters more than ever.

One approach discussed was the barbell strategy:

~50% in safer assets (cash, gold, bonds, defensive ETFs, dividend stocks)

~50% in growth or higher-volatility assets (US stocks, ETFs, crypto, selective opportunities)

This aligns closely with what I shared in my 2026 Game Plan — focusing on protecting downside while still staying invested for growth.

If you missed my 2026 Game Plan…

Many of you told me you couldn’t attend the live session.

So here’s the good news 🌱

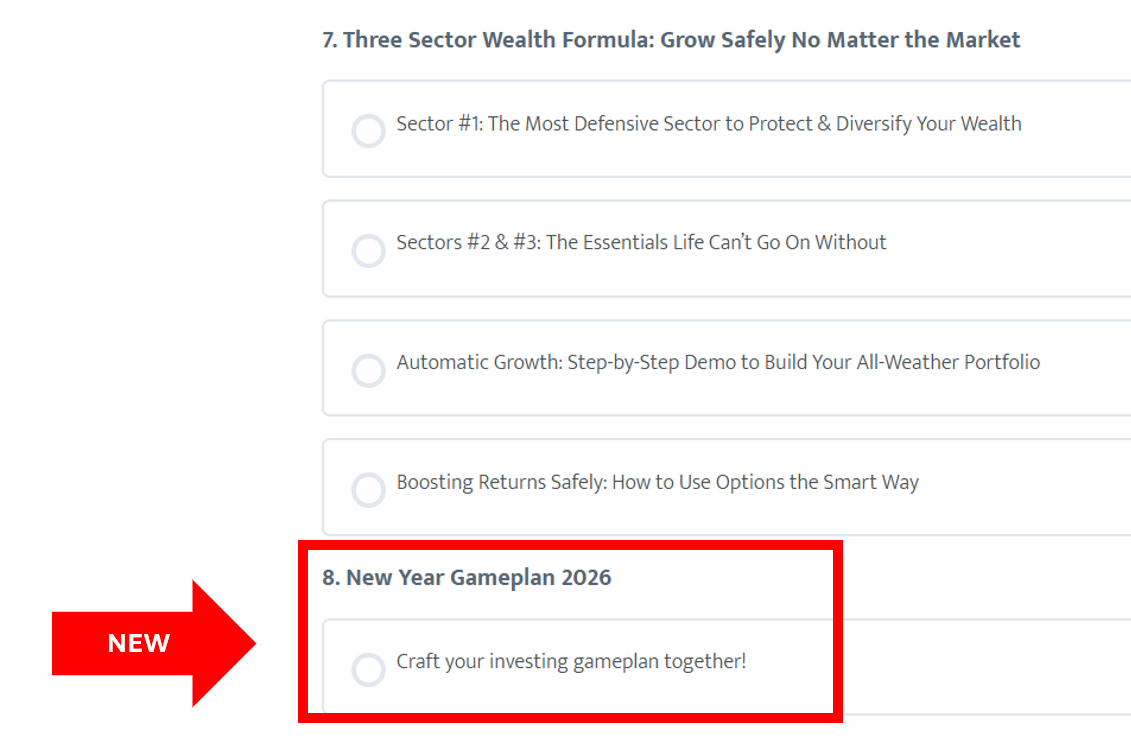

I’ve decided to include the full 2026 Game Plan recording as a bonus when you join my 7 Investing Course Bundle.

That means:

You unlock 8 courses instead of 7

Covering CPF, ETFs, portfolio strategy, and even options

For $47 as a New Year gift

If you want a clear, calm, step-by-step plan to grow your wealth more safely in 2026 — this is a good place to start.

Would love to have you join us,

and keep learning together—the Arigato way 💛

Meanwhile, check out this 👇️

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Reply