- Arigato Insiders Newsletter

- Posts

- Stock Surprise

Stock Surprise

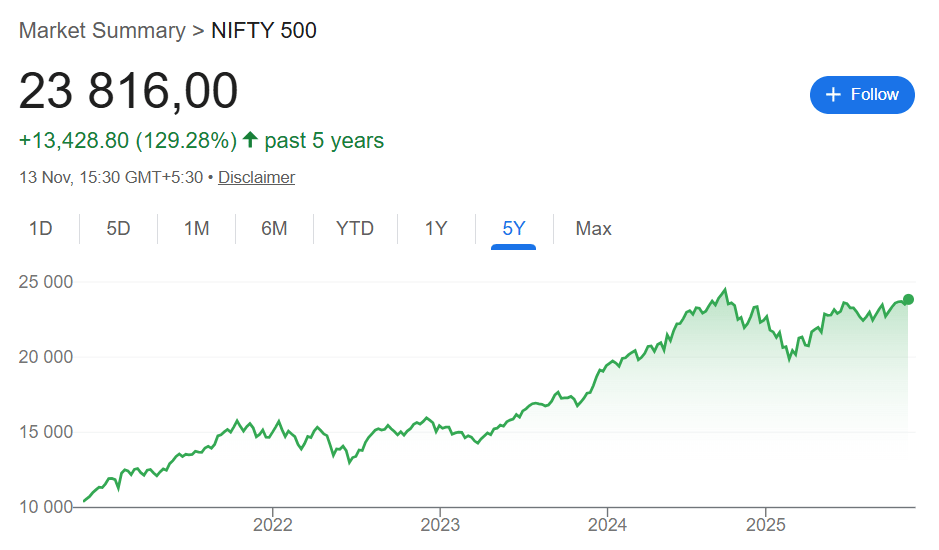

130% Growth!! 😲

Arigato, dear investor,

I was honestly shocked to discover that the Indian stock market’s Nifty 500 has gone up nearly 130% in the last 5 years — that’s even more than the US market! 😲

In my opinion, India is one of the best places to diversify my money for higher future growth potential, with its rising population and rapid economic development. I’ve been sharing about India ETFs investing with my Options To Freedom 3-day live bootcamp students for the past 2 years, and it continues to be an exciting opportunity.

Previously, I also did an in-depth interview on the Indian stock market with famous Indian fund manager Gautam Baid. If you want to catch his golden insights, you can watch the full video here:

👉️ Watch the interview 📽️

Meanwhile, as I travel, I’ve started preparing the slides for my upcoming 3-day Options To Freedom live bootcamp, happening 21–23 Nov. Over 80 of you have already signed up, and I can’t wait to show you step-by-step how it all works.

There are so many ETFs and market insights I can’t wait to share with you — including how to combine them with options safely to generate consistent monthly, and even weekly, passive income!

This round, I’m also doing a special edition: I’ve invited The Safe Investor to share technical analysis and additional options insights — so it’s going to be a real treat! 🎉

I still have 5 spots left for this special edition, so reply “bootcamp” if you want me to send you an exclusive link to join before all spots are gone.

Meanwhile, check out this 👇️

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Ads

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Reply