- Arigato Insiders Newsletter

- Posts

- SICK

SICK

regret?

Arigato, dear investor,

You probably wouldn’t believe this…

Right after I finished my webinar two days ago, I fell really sick.

Food poisoning. Fever. Full body aches.

I spent almost the entire next day just trying to recover.

I was feeling so cold from fever as my body was fighting the viruses inside.

Even as I’m writing this to you now, my body is mostly back… but let’s just say my stomach reminded me this morning that healing isn’t fully done yet.

And guess what caused it?

Me trying to save money.

If you’ve been following me for a while, you’ll know this about me:

I’m a saver.

I genuinely enjoy saving and investing my money more than spending it.

So when I was flying back from Dubai to Singapore, I booked an indirect flight through India — because the ticket was literally half the price of a direct flight.

On paper? Smart.

In reality? Not so much.

Longer travel time. Total exhaustion.

And most likely… where I picked up the food poisoning.

Suddenly, the $500 I “saved” didn’t feel like savings at all.

Recently, I’ve been reading Morgan Housel’s new book The Art of Spending Money.

One idea really stayed with me — regret.

Not “How much did I spend?”

But rather: What will I regret spending on… and what will I regret not spending on?

Here’s my honest list.

Things I’d regret spending money on:

– Expensive bags

– Unnecessary clothes

– Fancy restaurants that don’t really add value

Things I’d regret not spending money on:

– A comfortable hotel stay

– Meaningful, unforgettable travel experiences

– Courses that genuinely transform my mindset and skillset

This India flight was a very physical reminder for me.

That maybe… it’s time to slowly let go of my overly obsessive saver identity,

and start embracing a better balance between:

Enjoyment.

Comfort.

Convenience.

Productivity.

Don’t get me wrong — I’m deeply grateful for my saver habits.

They helped me build wealth early, invest more than my peers, and create freedom.

But as I step into 2026, I’m learning to transcend to a higher understanding of money.

Money isn’t just meant to be saved.

It’s meant to support the life you’re meant to live — and truly deserve. 💓

Does this resonate with you?

What would you like to improve or transcend in your relationship with money this year?

Hit reply and tell me — I’d genuinely love to hear.

And on a lighter note…

Despite how bad I felt yesterday, thanks to my mum (mums are truly the best), I recovered almost 80% in one day without even seeing a doctor.

I also managed to upload the 2026 Investing GamePlan Workshop Replay to my YouTube channel for you.

⏰ It’ll be taken down in 3 days (Sunday, 23:59) — so do catch it before it’s gone.

Meanwhile, check out this 👇️

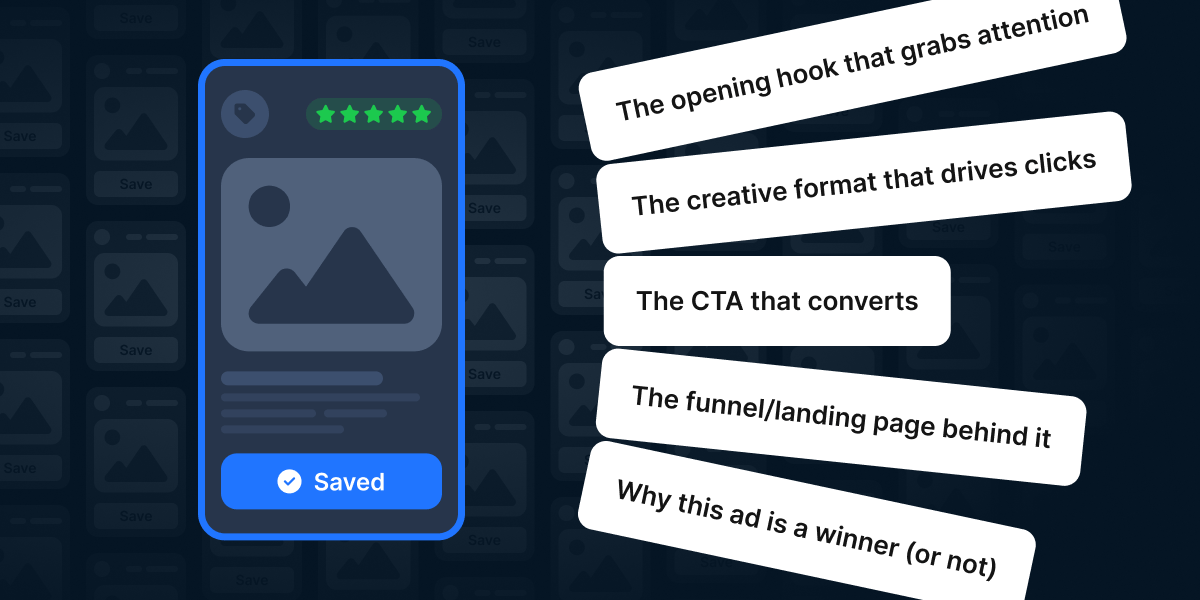

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Reply