- Arigato Insiders Newsletter

- Posts

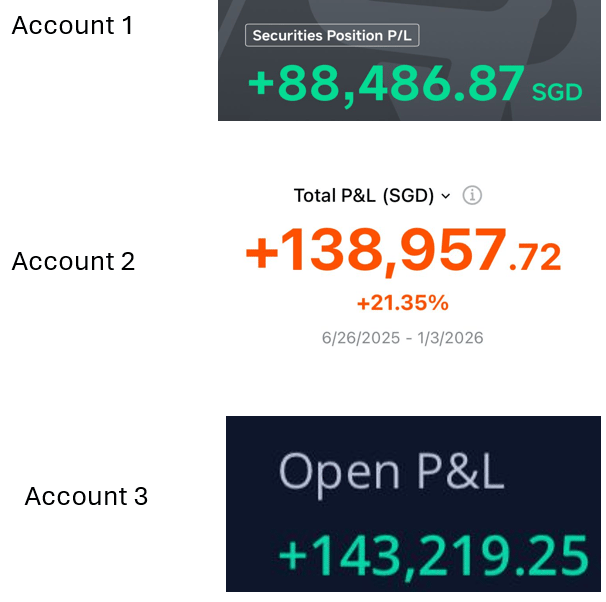

- my $369k profits

my $369k profits

how I did it

Arigato, dear investor,

At the very beginning of 2026, I hit a milestone I still need a moment to breathe into.

My portfolio crossed $369,000 in total profits.

Here are my 3 brokerage account dashboards:

What made this moment extra meaningful wasn’t just the number —

it was how I got here.

Back in 2022, I made a big decision:

I stopped relying on individual stock picking and rebuilt my portfolio around ETFs, then later layered in options carefully and intentionally.

Here are a few reflections I wrote down — maybe one of them will land with you today.

1. My average works out to about $123,000 per year

The market hasn’t been smooth.

There were drawdowns, scary headlines, and moments of doubt.

But staying invested — and continuing to invest — added up to roughly $123k per year.

My mind is honestly still catching up to those numbers.

Consistency compounds quietly… until one day it doesn’t feel quiet anymore.

2. 80% of what you think you need to do — you don’t

You don’t need to be “smart” at stock picking.

You don’t need to chase winners.

About 80% of my portfolio is in ETFs, and they’ve delivered incredibly well.

Letting go of the desire to pick the perfect stock was one of the most profitable decisions I’ve ever made.

Simple beats clever — almost every time.

3. The more I level up my character, the more money I make

Investing isn’t just strategy.

It’s patience.

It’s restraint.

It’s learning to wait without forcing outcomes.

To me, investing is a game of shedding, waiting, and zen-ing.

Money flows more easily when you stop fighting the process.

4. Options helped me accelerate my growth — SAFELY

When I combined options with ETFs, my portfolio growth sped up significantly — without taking reckless risk.

This level does require skill.

But skills are learned, not gifted.

No one is born knowing options.

I wasn’t either.

5. Everyone should build an ETF portfolio — even complete beginners

ETFs are one of the fastest paths to consistent, repeatable returns.

You can literally start with $5.

If you want to learn how to:

build a solid ETF portfolio

and combine it with options safely to increase returns

I’m hosting my 3-day Options To Freedom Bootcamp happening at the end of this month.

It’s where I break everything down step by step, so you can level up your 2026 faster!

6. You are limited only by your mind

The goals you set become the bottleneck.

What once felt impossible eventually becomes… obvious.

I honestly can’t even imagine what 2026 will fully look like yet —

but I can feel it in my bones that it’s going to be a REALLY BIG YEAR!

And as always, I’ll share everything I learn with you along the way.

Here’s to 2026 🥂

Meanwhile, check out this 👇️

Smarter CX insights for investors and founders

Join The Gladly Brief for insights on how AI, satisfaction, and loyalty intersect to shape modern business outcomes. Subscribe now to see how Gladly is redefining customer experience as an engine of growth—not a cost center.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

Reply