- Arigato Insiders Newsletter

- Posts

- How to Start Your Child’s Investing Journey

How to Start Your Child’s Investing Journey

A Comprehensive 7-Step Investing Guide

Arigato, dear investor,

Yesterday, I shared the story of two little girls — Bridget and Erica — who started investing when they were just 4 and 5 years old.

Fast forward a few years… and each of their portfolios is now up nearly $3,500 USD (~$4,500 SGD).

The best part? This isn’t some “rich family with crazy capital” story.

This is about two parents — Ben and Evelyn — who started learning how to invest for themselves… and then quietly started doing the same for their daughters.

After I posted their story, my inbox and DMs blew up with the same question:

“How do I open an account for my kids so they can start too?”

So, here’s a step-by-step guide — based on what Ben and Evelyn actually do — and how you can use Longbridge, a MAS-regulated platform, to kickstart your child’s investing journey.

1. Understand the legal age for investing

In Singapore, you need to be 18 years old to open a brokerage account under your own name.

For children under 18, parents open the account in their own name and deposit the child’s money into it — things like ang pao (red packets), leftover pocket money, and birthday gifts.

That’s exactly what Ben and Evelyn have been doing from day one. Whenever Bridget and Erica receive cash gifts, their parents deposit it straight into the girls’ investment accounts. Over time, these little amounts really add up.

2. Choose a brokerage (and get free shares!)

Brokerages today compete hard for new customers, and many offer attractive account-opening rewards.

Right now, I personally think Longbridge has one of the best deals in town.

Open and fund an account, and you can receive free shares — including big names like Nvidia, Apple, Google, and eBay — worth up to $800 SGD.

All you need to do:

Fund the required amount

Complete the required number of buy trades

3. Complete your buy trades using fractional shares

Here’s the trick — you don’t need to spend thousands to qualify.

With fractional shares, you can buy less than 1 whole share, starting from as little as $1 USD.

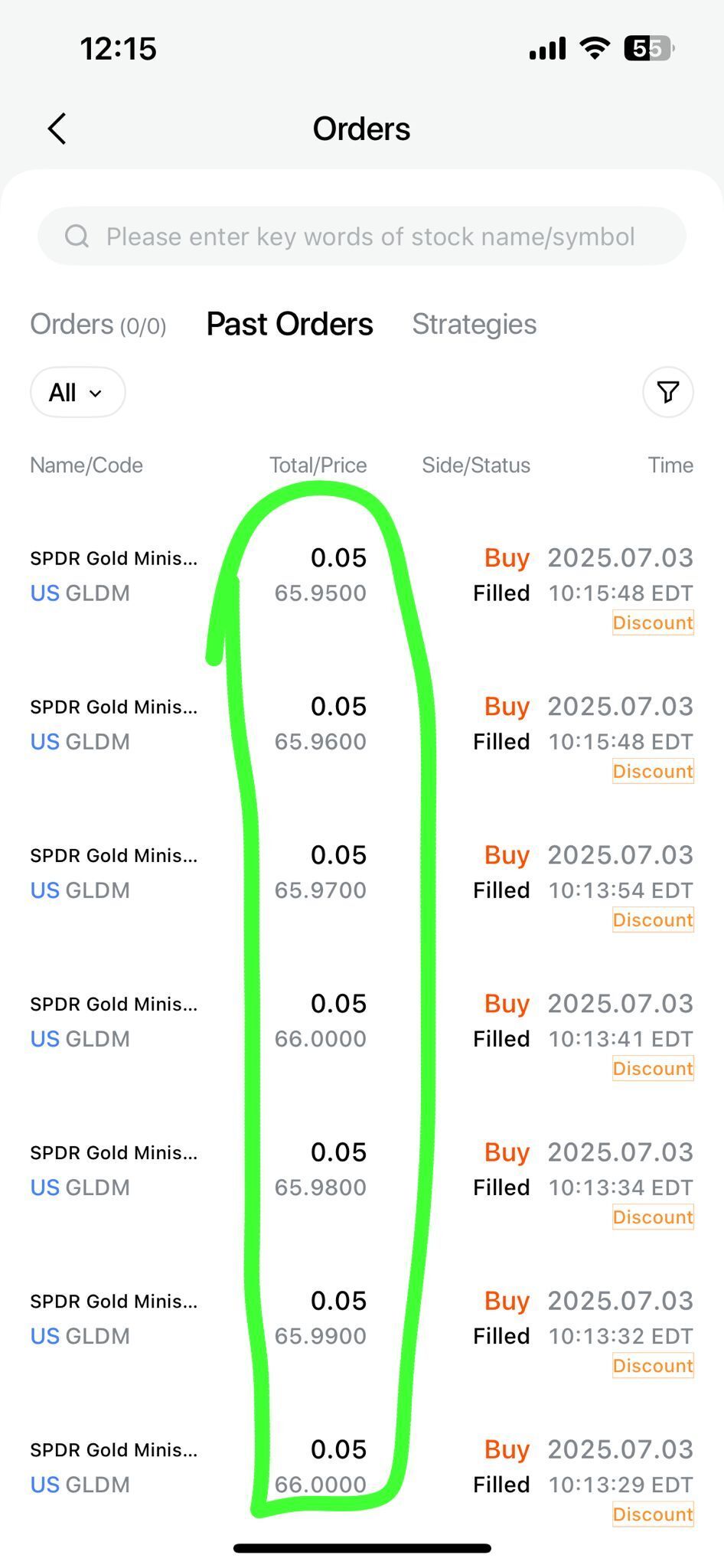

Example from my own account:

I bought 0.05 share of the Gold ETF (GLDM) to complete my buy trades, and repeated this 8 times.

Let’s do the math:

0.05 × $66 × 8 = $26.4 USD spent

That’s it. I spent $26.4 USD and received $800 SGD worth of free shares.

That’s close to 2500% return on my investment!

Worth it? Absolutely.

4. Pick stocks or ETFs for your child

Ben and Evelyn make this fun. They involve their girls by asking:

“What companies do you see every day? Which ones do you like?”

The answers become stock picks:

Apple $AAPL — because they use iPads

Amazon $AMZN — where they shop

Google $GOOG — for YouTube

McDonald’s $MCD — for Happy Meals

Over 4 years, these simple brand recognitions turned into real investments — and real profits.

If individual stocks feel overwhelming, you can start with something like an S&P 500 ETF, which makes your child a part-owner of the top 500 US companies instantly.

5. Park idle cash in Money Market Funds (MMFs)

When I deposited $100K SGD into Longbridge to unlock the free shares bonus, I didn’t invest all of it immediately.

Instead, I parked the cash in USD Money Market Funds under Cash Plus to earn about 4.12% annual interest.

So far, my idle cash has generated $221+ in interest, paid daily.

You can withdraw anytime with no fees

MMFs are safe, short-term investments (very low risk)

Right now, there’s even a 6% Interest Boost Coupon for 90 days (up to SGD 2,000).

6. Convert currency if buying US stocks/options

I often convert SGD → USD inside Longbridge because:

The exchange rates are much better than those offered by banks (and are very close to the Google exchange rate)

I believe in the long-term strength of the US economy

Higher MMF interest rates for USD as stated above

I mainly invest in US stocks and options

For example — my student Peter generated $3,500 USD in 5 weeks using one of my US options strategies. I share this free inside my Options to Freedom Masterclass.

If you prefer to avoid currency risk, you can keep SGD and invest in SG stocks — there’s also an SGD MMF with ~2.19% yield.

7. Enjoy 0 fees with Longbridge (special campaign)

Right now, Longbridge offers:

0 commission for US, SG, HK stocks

No custody fees, deposit/withdrawal fees, currency exchange fees, inactivity fees, or account maintenance fees

During this campaign period, Longbridge is also offering platform fee rebates (coupons are provided with up to 100 uses per month for 3 months, with a certain rebate cap). As you can see, all my fees are being rebated back to me, which means I can buy and sell stocks with zero fees!

Ready to start?

If you found this guide useful and want to support my work, you can open your Longbridge account here:

👉 rebrand.ly/longbridge

Here’s the secret though — Ben and Evelyn learned investing first. They took the time to educate themselves, so they could confidently guide their daughters. If you want to be give your kids this amazing head start, you’ve got to start with you first.

Not sure where to begin? Come join my free 2-hour investing masterclass. I’ll walk you through everything step-by-step, even if you’re a complete beginner, so you can start investing safely and peacefully — the Arigato way.

Meanwhile, check out this 👇️

CTV ads made easy: Black Friday edition

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting — plus creative upscaling tools that transform existing assets into CTV-ready video ads. Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Reply