- Arigato Insiders Newsletter

- Posts

- Did you see this?!

Did you see this?!

3 points

Arigato, dear investor,

Most of my sharing over the past few years has been online.

So when Market Wise Asia and Plus500 invited me to come on stage to share my 2026 Investing Game Plan, it felt especially meaningful.

It’s been a while since I last spoke live to close to 300 people in one room — and I honestly forgot how powerful that energy can be. Seeing familiar faces, thoughtful questions, and that moment when things finally click for people…

What made me happiest wasn’t the stage itself, but hearing so many people came up to me and say:

“Your session is so insightful! I finally feel clearer about how I want to invest into 2026.”

That clarity is exactly why I do this.

What I learnt from the Trading Summit (and my honest take)

I also learnt a lot from the other speakers that day. Here are the three key themes that stood out to me — and how I personally think about them.

1️⃣ Gold as a hedge, not a hype trade

One important reminder shared was that gold doesn’t move in tandem with the stock market.

Gold prices have risen sharply in recent years due to:

The devaluation of the US dollar

Growing loss of confidence in the US

Investors diversifying away from US-centric assets

Many investors today hold gold not just as a value store, but as a hedging tool.

My take:

With gold prices pulling back lately, this could actually be a more reasonable level to start looking at it calmly.

Instead of buying gold outright, I personally prefer to use options on gold ETFs. During our recent 3-Day Options To Freedom Bootcamp, our community spotted a really interesting gold-related ETF to apply options strategies on.

Moments like this remind me how powerful it is to invest together, learning from shared insights as we position for 2026 and beyond.

2️⃣ Don’t overlook the Singapore market

Another strong point discussed was the Singapore stock market.

With:

The government injecting liquidity

Potential new ETFs tracking SG mid-cap companies

A renewed focus on strengthening the local market

SG stocks may quietly surprise many investors.

My take:

I still personally favour the SG market mainly for dividend stability.

Certain high-quality SG stocks — especially the local banks — have shown consistent performance over time.

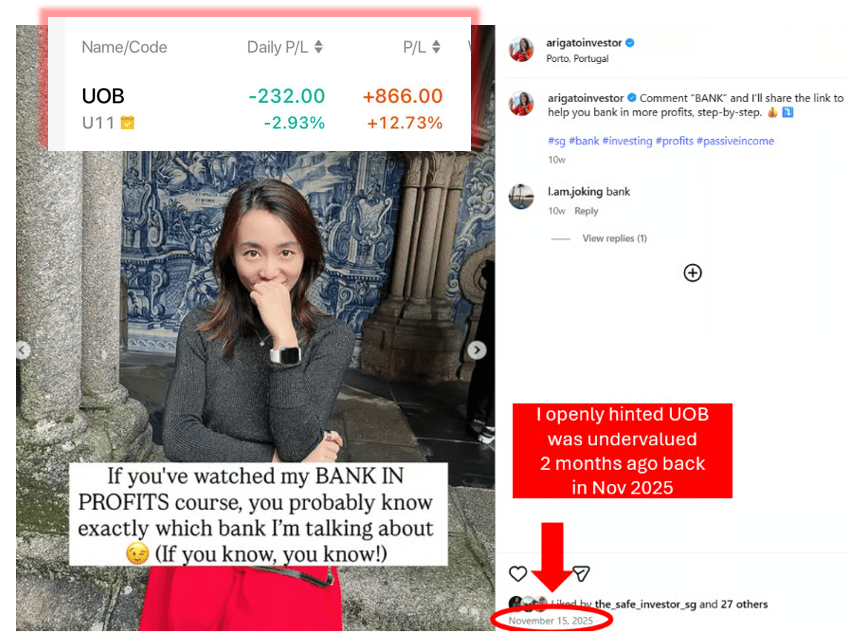

For example, I added UOB in November last year when valuations were attractive and dividend yields were over 6% per year.

Today:

The stock is up over 12% in capital gains

Dividends at 6%/year

More dividend and capital gains in the years to come

Calm, boring, and reliable — exactly how I like my long-term investments.

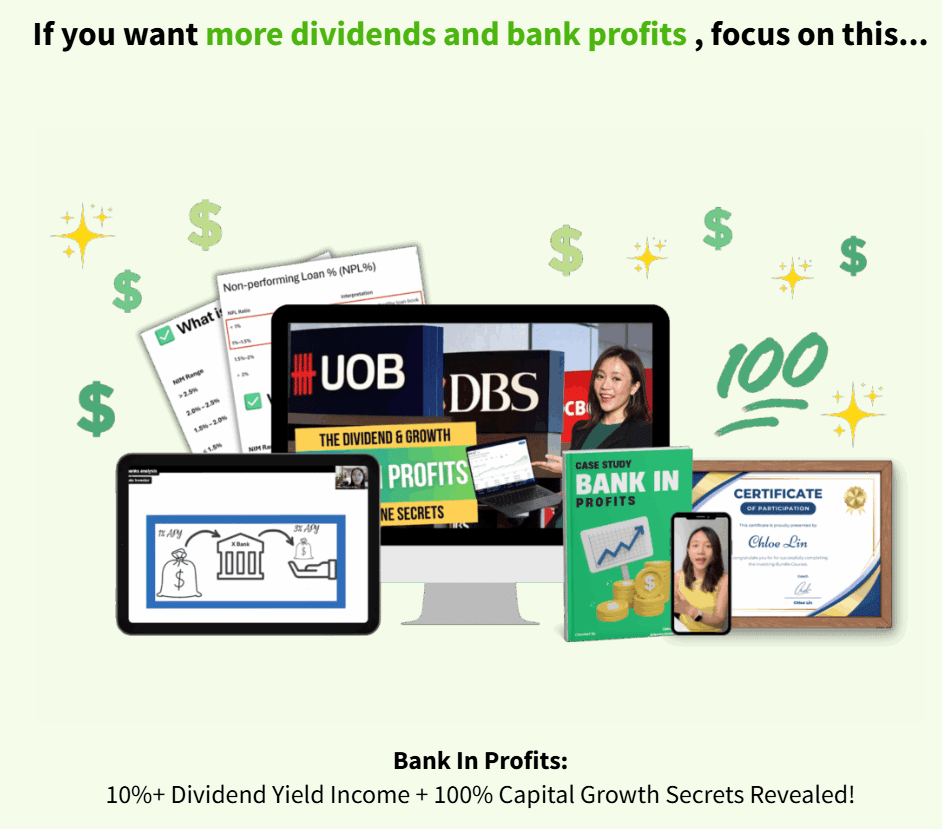

If you’d like to learn how I personally value SG banks, I break this down step by step inside my 7 Investing Course Bundle.

3️⃣ Defense sector — positioning for the world we’re in

A topic that came up repeatedly was the defense sector.

With ongoing global conflicts and rising geopolitical tensions, many investors and traders are increasingly bullish on defense-related assets.

There was also discussion around how Donald Trump has historically been very clear about one thing — keeping the U.S. a global superpower, not just through soft power, but through strong defense capabilities as well.

This often translates into sustained defense spending and tailwinds for selected defense companies and ETFs.

My take:

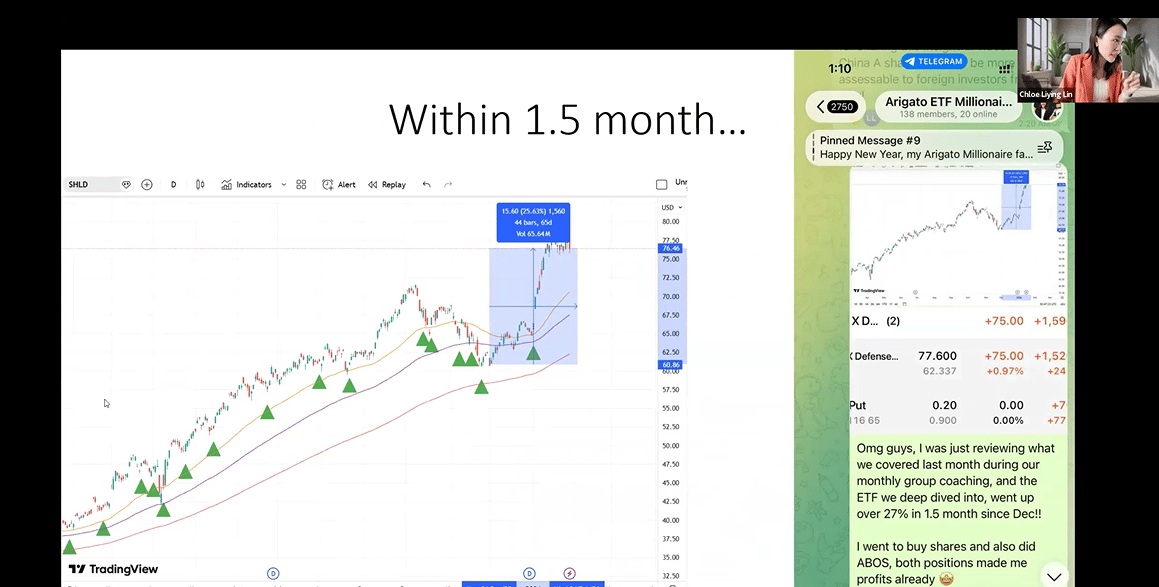

During this weekend’s Options To Freedom Trading Bootcamp, we spent a fair bit of time breaking down defense ETFs — understanding which ones make sense and why.

One defense ETF that I personally bought together with my community in December went up almost 25% in just about 1.5 months.

This isn’t about chasing hot themes.

It’s about selecting the right ETF based on the right market conditions.

And that’s really the heart of how I invest.

If you missed joining this round of Options To Freedom and would like to learn how I:

Select ETFs based on market conditions

Use options to generate income and manage risk

Build clarity and calm heading into 2026

You can sign up for the next cohort here:

👉 rebrand.ly/optionstofreedom

Let’s continue learning, positioning, and growing — together — into 2026 and beyond.

Meanwhile, check out this 👇️

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

Arigato!

Chloe

Arigato Investor

Just a quick heads-up 🌸 Except for Instagram, where I may reply if you comment on my posts, I’ll never initiate a private message to you on any platform. So if you ever get a DM from someone claiming to be “Chloe” or “The Arigato Investor” on Telegram or TikTok — please know that’s not me. It’s a scammer impersonating my account. Stay safe and always double-check 💛

The information provided in this newsletter is for informational purposes only and does not constitute financial advice. Readers should seek their own independent financial advice before making any investment decisions. Please note that the opinions expressed in this newsletter are Chloe's own and do not represent the views of any organization. Always perform your own research and due diligence before investing. 💛

Know what works before you spend.

Discover what drives conversions for your competitors with Gethookd. Access 38M+ proven Facebook ads and use AI to create high-performing campaigns in minutes — not days.

Reply